Searching in the app store is very important in the discovery of new apps.

In iOS, 47% of users said that they found a new application via the search engine in the App Store, while 53% of users did the same in Google Play.

But, what exactly do users write in the search box in the App Store and Play Store in order to find these applications?

The answer isn’t easy to come by. Unlike web search, searching in app stores remains a mystery for most, and only the two large platforms know with certainty what their users are looking for.

The search estimates of the different ASO tools often depend on Apple’s search priority or the popularity of Apple’s search ads (which only provide a score, not volume of actual searches) at best. However, most of the time it is mixed with other indicators, mainly from web-based searches.

It is also true that the developers have taken advantage of the Search Ads tool from Apple to buy the first placed positions in the search results, and thereby considerably accelerate new user aquisition.

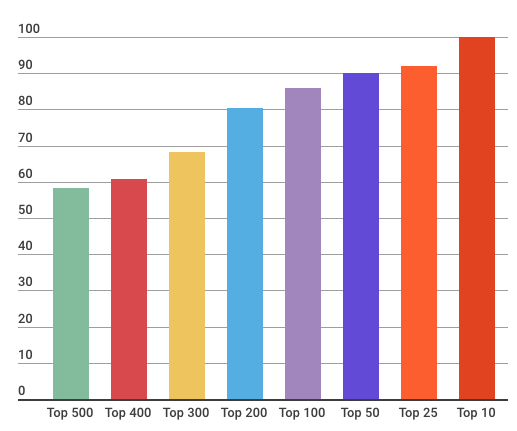

In a study conducted last year by John Koetsier, it was demonstrated with 500 keywords that 9 out of 10 keywords were pre-qualified. This means that users have a habit of searching in the app stores for brands they have already heard of in other places. And the main unbranded keywords in the top 100 were related to simple games or utility applications: games, vpn, free games, photo editor, music, calculator, weather.

With the main keywords dominated by the brands and only some exceptions of unbranded keywords, most of them very basic, is the queue for the search of applications significantly long? Let’s see.

Image: Tune

The image indicates how many search terms in the App Store are pre-qualified, or correspond to brands

Besides brands, what else to users search for?

A few years ago, Relly Brandman, Google’s product manager explained in a video, that there were two types of searches:

- Users who already know what they are looking for.

- Users who do not know what they want and search for keywords like ‘puzzle’ or ‘goblin’.

Following this, Google Play search and discovery chief Ankit Jain also offered a deeper insightinto the search behaviour of Google Play users on Google I / O.

- Jain details two types of search: categorical and navigation. Categorical queries are broad search terms, such as free gamesor train schedules, while navigation queries are exact search terms, such asforniteor whatsapp, that is, brand searches.

- He also said that of 12% of daily active users (DAU), 50% seek applications weekly, and Google also receives six million unique phrases searched monthly.

Assuming there are still millions of unique phrases searched each month, how many of these unique queries generate a significant volume and how many are from brands and not from brands?

To know which queries generate a greater volume, the trends in Apple searches that AppKeywords shows us is a good place to analyze.

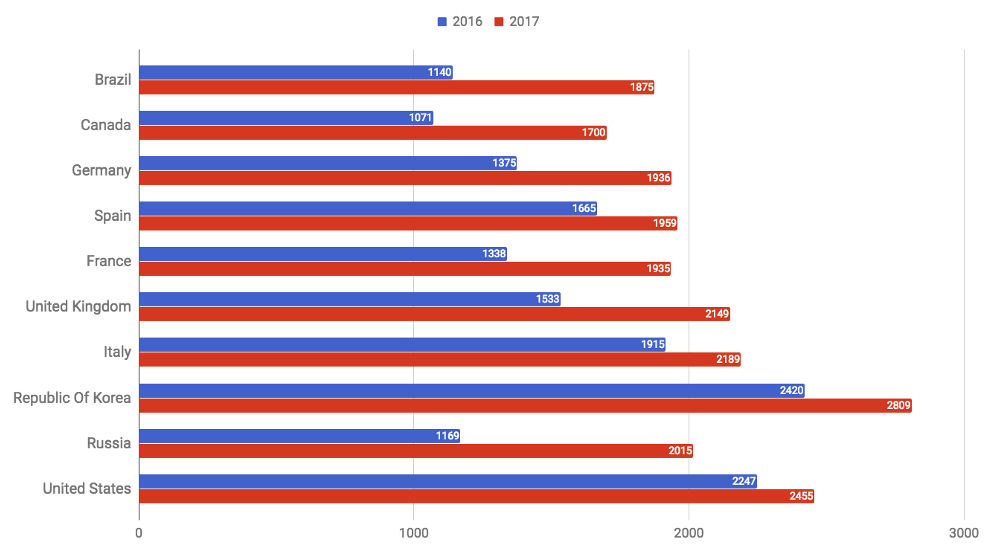

Next we will see, according to the AppKeywords tool, the global number of unique search trends in iOS in different countries for 2016 (blue graphics) compared to 2017 (red graphics).

Image: AppKeywords

Number of unique search queries in the App Store, 2016 vs 2017

According to this data, there were 2,455 unique search phrases in the United States in 2017, compared to 2,247 the previous year. This means that at least users are looking for twice as many high-volume queries as in 2015, when SensorTower shared unique data on search trends.

What does Autocomplete show us about search behaviours?

Autocomplete is a common feature for search engines, which suggests shortcuts to the user which shows the most likely results when writing a query.

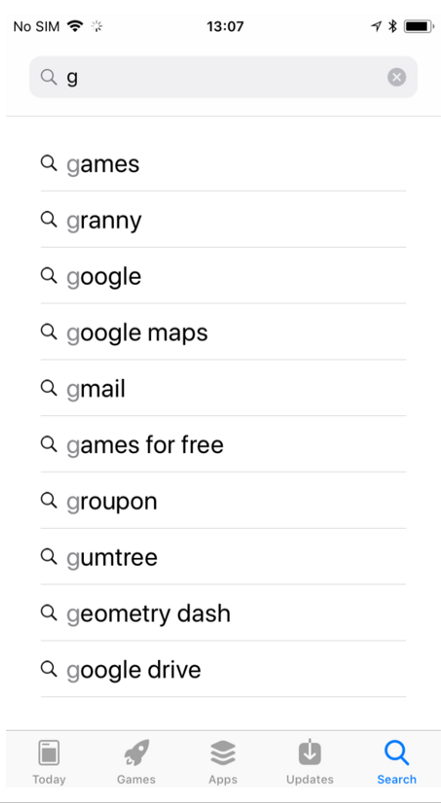

When users type a single letter such as ‘g‘, the App Store displays a list of 10 suggested searches that begin with that letter. If a user continues writing, for example, ‘ga …‘, a new list of suggestions starting with ‘ga‘, etc. is loaded. The order in which the automatic suggestions are displayed is determined according to the score of the Apple Priority Index.

Image: App Store

If we write all the letters of the alphabet from ‘a’ to ‘z’, and do a quick analysis of the 260 sentences suggested by Apple, we can verify that of all these (10 for each letter of the alphabet), only 13 sentences ( 5%) seem to be unbranded terms: bible, calculator, countdown, email, free games, games, mail, maps, music, football world, news, notes, photo editor.

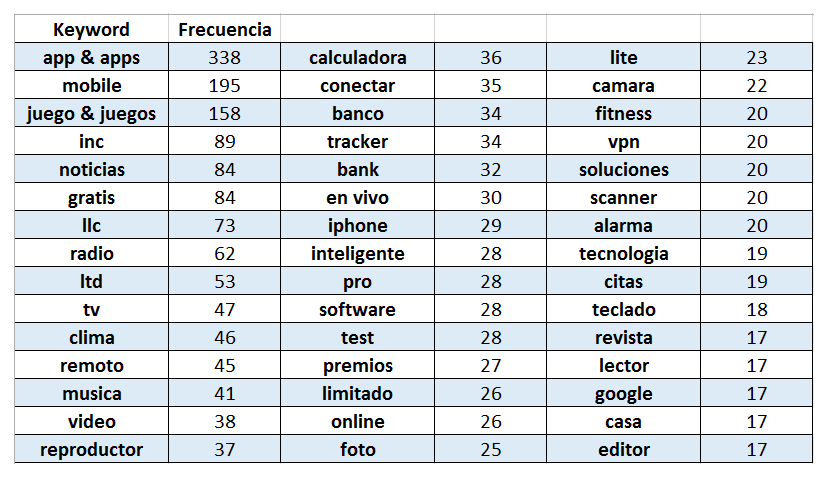

If we write all the combinations of 2 letters, we will get a list of more or less 8,300 sentences. If we count the duplicates, we can obtain a list similar to this one:

Interestingly, terms related to brands such as inc or ltd, appear as common words as well. Apart from this, audio and video applications, as well as utilities, come back to dominate.

Browsing searches seem to be much more common for games than for applications: ‘games’ appears as part of a query 131 times (‘game’ 27 times), in queries that describe genres such as skating games, zombie games, action games or arcade games.

Search-to-Install will eliminate many uncertainties

The short and medium queue in the search for applications is still firmly in the hands of brands with some highly competitive generic keywords. The longest queue of relevant keywords remains a mystery that each application developer must solve individually.

Luckily, there is help on the way. A few months ago, Google launched new organic search data in the “Acquisition of users” section in the Google Play console.

This enables them to divide the organic traffic of Play Store in Search and browse, that is, if a user has found the list of applications through a search query instead of browsing the store.

It also provides data on the installations generated by keyword for the first time. Google displays the 1,000 best search terms for which the app is ranked, along with its individual conversion rate, broken down into the store that includes visitors, installers, retained installers or buyers.

The next few months will be very interesting for app developers who will be able to demystify the search for applications and finally answer the question “How do users search for my applications?” With real data from the real world.